Commercial Law League of America

CLLA  NATIONAL CONVENTION

NATIONAL CONVENTION

MAY 15-17, 2024 SWISSÔTEL, CHICAGO

Commercial Law League of America

CLLA  NATIONAL CONVENTION

NATIONAL CONVENTION

MAY 15-17, 2024

SWISSÔTEL, CHICAGO

CLICK ON THE DAY BELOW TO VIEW THE SESSIONS & HANDOUTS

WEDNESDAY

May 15, 2024

THURSDAY

May 16, 2024

FRIDAY

May 17, 2024

SPEAKERS

Wednesday, May 15

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

4:00 – 5:00 P.M. CST

5:00 – 6:00 P.M. EST

2:00 – 3:00 P.M. PST

LEGISLATIVE FORUM

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Peter Califano, Niesar & Vestal LLP, San Francisco, CA; Conor Kelly, Webster, Chamberlain & Bean, Washington, DC; Dan Kerrick, Hogan McDaniel, Wilmington, DE;

Gilbert M. Singer, Marcadis Singer P.A., Tampa, FL

CLLA panelists will provide a review of CLLA legislative and government affairs efforts during the past year, inform members about the political make-up of the current Congress and possibilities for legislation impacting the commercial law, and educate attendees about the legislative process; including drafting legislation and policy positions for consideration by members of Congress and aligned interested parties and organizations.

Thursday, May 16

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

8:45 – 9:45 A.M. CST

9:45 A.M. – 10:45 A.M. EST

6:45 – 7:45 A.M. PST

GOOD FORWARDERS GO BAD

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Robert Ash, Radius Global Solutions, Fair Lawn, NJ; Matias Eduardo Garcia, Barnett & Garcia, PLLC, Austin, TX; Bryan Press, Metro Group Maritime, Livingston, NJ

Join us for a practical discussion between a panel of agencies and attorneys as we talk about how to handle cases that we’d rather walk away from, but it’s what you do for a good client! We’ll be discussing some do’s and don’ts on handling those situations and best practices for the relationship. This session will also touch on hot topics and relationship management tips.

HOT TOPICS IN BANKRUPTCY CASE LAW

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

SPEAKER: Ronald Peterson, Of Counsel at Jenner & Block, LLP, Chicago, IL

This session will be a summary of important bankruptcy cases decided through March 29, 2024, including recently decided U.S. Supreme Court cases.

10:00 – 11:00 A.M. CST

11:00 – NOON EST

8:00 – 9:00 A.M. PST

PACKERS & STOCKYARDS ACT—HIDDEN STATUTORY LIENS THAT WILL BITE YOU IN THE PACA!

ROOM: Alpine (Lucerne Level)

![]()

![]()

SPEAKER: George F. Braun, Law Offices of George Braun, Washington, DC

Our speaker will outline and discuss the use of the Packer & Shippers Act and Perishable Agricultural Commodities Act as it applies to collections in the agricultural industry. Both transactional and litigation with questions and answers from the audience.

THE NEW DAY OF REAL ESTATE: HOW THE MARKET RESET IS IMPACTING BANKRUPTCY LAW

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

SPEAKERS: Hon. Thomas Lynch, US Bankruptcy Court, Northern District of IL, Rockford, IL; Jack Rose, Law Offices of Jack Rose, PLLC, LLC, Bronxville, NY; Matthew Tabloff, Hilco Real Estate, LLC, Northbrook, IL

Our speakers will examine the ongoing volatility of the real estate market and trends to watch for by bankruptcy practitioners. The discussion will examine how to do workouts in an evolving lending environment and evaluate whether filing bankruptcy is the best course of action. The speakers will also discuss takeaways from the WeWork cases and other recent bankruptcy filings. They also will consider such topics as the enforceability of arbitration clauses and handling pre-negotiation letters. Our speakers will also address such issues as dealing with landlord liens and waivers, and why residential property conversions may not be the answer in this environment.

1:30 – 2:30 P.M. CST

2:30 – 3:30 P.M. EST

11:30 A.M. – 12:30 P.M. PST

ETHICAL TIPS FROM MOVIES & TV LAWYERS

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

![]()

SPEAKERS: Ben H. Farrow, Anderson, Williams & Farrow, LLC, Montgomery, AL;

William H. Thrush, Friedman, Framme & Thrush, P.A., Owings Mills, MD

Ethical legal actions are at the core of any and every successful law-related business endeavor, so attorneys, agencies and forwarders will find tremendous value, insight, and education in an entertaining and informative way, which will benefit your business, improve your caseload, and illustrate the value of using a CLLA vetted and approved attorney. Our speaker will use 5-6 television and movie clips to demonstrate some typical ethical issues and apply the model rules to provide guidance.

FOUR YEARS OF THE SBRA: HOW IS IT WORKING?

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

PANELISTS: Matthew Brash, Newpoint Advisors Corporation, Schaumburg, IL;

Zach B. Shelomith, LSS Law, Ft. Lauderdale, FL; Beverly Weiss Manne, Tucker Arensberg, PC, Pittsburgh, PA; Hon. Mary Ann Whipple, US Bankruptcy Court, Northern District of OH, Toledo, OH

The Small Business Reorganization Act is four years old. What lessons have we learned? In the post-COVID world, does Subchapter V work better for small businesses? How do creditors view the Subchapter V experience? What have Subchapter V trustees learned about their role in a case? Join our experienced panel as they discuss practical issues addressing the ways in which Subchapter V is working and perhaps not working so far.

2:45 – 4:15 P.M. CST

3:45 – 5:15 P.M. EST

12:45 – 2:15 P.M. PST

CAUTION, BEWARE OF POTHOLES IN CHAPTER 11 BANKRUPTCY

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Hon. Janet Baer, US Bankruptcy Court, Northern District of IL, Chicago, IL; Candice Kline, Saul Ewing, LLP, Chicago, IL; Hon. Judith Fitzgerald (Ret.), Tucker Arensberg, PC, Pittsburgh, PA; Thomas R. Fawkes, Tucker Ellis LLP, Chicago, IL

The program will provide an opportunity for attendees to ask the experts about Chapter 11 cases and obtain guidance on identifying and avoiding the potholes along the way – starting with first day motions and continuing through plan confirmation.

Discussion topics to include:

- What to look for in the first day motions.

- Avoiding stay violations.

- How to reserve your rights if there is a DIP lender.

- Understanding cash collateral order(s) and monthly operating reports.

- Determining if you have reclamation rights.

- What sale motions mean for creditors.

- Cure amounts and what to do if your agreement is assumed and assigned (or not assumed).

- Identifying critical vendors.

Friday, May 17

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

8:30 – 9:30 A.M. CST

9:30 – 10:30 A.M. EST

6:30 – 7:30 A.M. PST

CYBERSECURITY FOR LAW FIRMS

ROOM: Alpine

![]()

![]()

SPEAKER: Marco Alcala, Alcala Consulting, Inc., Pasadena, CA

In the upcoming cybersecurity session tailored for legal professionals, attendees will gain invaluable insights into fortifying their digital practices against today’s most pervasive cyber threats. The program will kick off with an in-depth exploration of business email compromise (BEC), a type of cyber fraud that could devastate a firm’s financial integrity. We will unravel the deceptive tactics used by cybercriminals and provide practical defense strategies. The session will then pivot to the menacing landscape of ransomware attacks, discussing how these malicious software breaches can lock down critical data and disrupt legal operations. Participants will learn how to not only prevent such attacks but also how to respond effectively if they occur. Lastly, we will delve into the robust cybersecurity controls necessary for the protection of confidential client information. From encryption to two-factor authentication, lawyers will leave equipped with a toolkit of measures designed to uphold their ethical obligations in maintaining client confidentiality in the digital age.

9:45 – 11:00 A.M. CST

10:45 – 12:00 A.M. EST

7:45 – 9:00 A.M. PST

LITIGATING ON DUAL FRONTS — EXAMINING WAR STORIES AND REAL-WORLD CASES INVOLVING LITIGATION INSIDE AND OUTSIDE BANKRUPTCY

ROOM: Alpine

![]()

![]()

![]()

PANELISTS: Joseph A. Marino, Marino, Mayers & Jarrach, LLC, Clifton, NJ; Randall Woolley, Darcy & Devassy PC, Chicago, IL; Kirk B. Burkley, Bernstein-Burkley, PC, Pittsburgh, PA

The panelists will address “cross-over” issues in the gray areas of the law that affect both bankruptcy and creditors’ rights attorneys. The program will be centered on real-world cases handled both inside and outside of bankruptcy. Discussions topics will include: fraudulent transfer cases (where a judgment against the principles is non-dischargeable), Ponzi scheme cases, (when there is a presumption of insolvency), RICO cases (when there is NO presumption of insolvency), director and officer litigation arising out of bankruptcy cases and judgment collection, dealing with bad faith filings and vexatious litigants, application of the Colorado River Doctrine and first to file rule, and debtor’s standing to prosecute claims outside of bankruptcy court.

CLICK ON THE DAY BELOW TO VIEW THE SESSIONS & HANDOUTS

WEDNESDAY

May 15, 2024

THURSDAY

May 16, 2024

FRIDAY

May 17, 2024

SPEAKERS

Wednesday, May 15

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

LEGISLATIVE FORUM

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Peter Califano, Niesar & Vestal LLP, San Francisco, CA; Conor Kelly, Webster, Chamberlain & Bean, Washington, DC; Dan Kerrick, Hogan McDaniel, Wilmington, DE;

Gilbert M. Singer, Marcadis Singer P.A., Tampa, FL

CLLA panelists will provide a review of CLLA legislative and government affairs efforts during the past year, inform members about the political make-up of the current Congress and possibilities for legislation impacting the commercial law, and educate attendees about the legislative process; including drafting legislation and policy positions for consideration by members of Congress and aligned interested parties and organizations.

Thursday, May 16

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

GOOD FORWARDERS GO BAD

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Robert Ash, Radius Global Solutions, Fair Lawn, NJ; Matias Eduardo Garcia, Barnett & Garcia, PLLC, Austin, TX; Bryan Press, Metro Group Maritime, Livingston, NJ

Join us for a practical discussion between a panel of agencies and attorneys as we talk about how to handle cases that we’d rather walk away from, but it’s what you do for a good client! We’ll be discussing some do’s and don’ts on handling those situations and best practices for the relationship. This session will also touch on hot topics and relationship management tips.

HOT TOPICS IN BANKRUPTCY CASE LAW

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

SPEAKER: Ronald Peterson, Of Counsel at Jenner & Block, LLP, Chicago, IL

This session will be a summary of important bankruptcy cases decided through March 29, 2024, including recently decided U.S. Supreme Court cases.

PACKERS & STOCKYARDS ACT—HIDDEN STATUTORY LIENS THAT WILL BITE YOU IN THE PACA!

ROOM: Alpine (Lucerne Level)

![]()

![]()

SPEAKER: George F. Braun, Law Offices of George Braun, Washington, DC

Our speaker will outline and discuss the use of the Packer & Shippers Act and Perishable Agricultural Commodities Act as it applies to collections in the agricultural industry. Both transactional and litigation with questions and answers from the audience.

THE NEW DAY OF REAL ESTATE: HOW THE MARKET RESET IS IMPACTING BANKRUPTCY LAW

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

SPEAKERS: Hon. Thomas Lynch, US Bankruptcy Court, Northern District of IL, Rockford, IL; Jack Rose, Law Offices of Jack Rose, PLLC, LLC, Bronxville, NY; Matthew Tabloff, Hilco Real Estate, LLC, Northbrook, IL

Our speakers will examine the ongoing volatility of the real estate market and trends to watch for by bankruptcy practitioners. The discussion will examine how to do workouts in an evolving lending environment and evaluate whether filing bankruptcy is the best course of action. The speakers will also discuss takeaways from the WeWork cases and other recent bankruptcy filings. They also will consider such topics as the enforceability of arbitration clauses and handling pre-negotiation letters. Our speakers will also address such issues as dealing with landlord liens and waivers, and why residential property conversions may not be the answer in this environment.

ETHICAL TIPS FROM MOVIES & TV LAWYERS

ROOM: Alpine (Lucerne Level)

![]()

![]()

![]()

![]()

SPEAKERS: Ben H. Farrow, Anderson, Williams & Farrow, LLC, Montgomery, AL;

William H. Thrush, Friedman, Framme & Thrush, P.A., Owings Mills, MD

Ethical legal actions are at the core of any and every successful law-related business endeavor, so attorneys, agencies and forwarders will find tremendous value, insight, and education in an entertaining and informative way, which will benefit your business, improve your caseload, and illustrate the value of using a CLLA vetted and approved attorney. Our speaker will use 5-6 television and movie clips to demonstrate some typical ethical issues and apply the model rules to provide guidance.

FOUR YEARS OF THE SBRA: HOW IS IT WORKING?

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

PANELISTS: Matthew Brash, Newpoint Advisors Corporation, Schaumburg, IL;

Zach B. Shelomith, LSS Law, Ft. Lauderdale, FL; Beverly Weiss Manne, Tucker Arensberg, PC, Pittsburgh, PA; Hon. Mary Ann Whipple, US Bankruptcy Court, Northern District of OH, Toledo, OH

The Small Business Reorganization Act is four years old. What lessons have we learned? In the post-COVID world, does Subchapter V work better for small businesses? How do creditors view the Subchapter V experience? What have Subchapter V trustees learned about their role in a case? Join our experienced panel as they discuss practical issues addressing the ways in which Subchapter V is working and perhaps not working so far.

CAUTION, BEWARE OF POTHOLES IN CHAPTER 11 BANKRUPTCY

ROOM: Lucerne 3 (Lucerne Level)

![]()

![]()

![]()

PANELISTS: Hon. Janet Baer, US Bankruptcy Court, Northern District of IL, Chicago, IL; Candice Kline, Saul Ewing, LLP, Chicago, IL; Hon. Judith Fitzgerald (Ret.), Tucker Arensberg, PC, Pittsburgh, PA; Thomas R. Fawkes, Tucker Ellis LLP, Chicago, IL

The program will provide an opportunity for attendees to ask the experts about Chapter 11 cases and obtain guidance on identifying and avoiding the potholes along the way – starting with first day motions and continuing through plan confirmation.

Discussion topics to include:

- What to look for in the first day motions.

- Avoiding stay violations.

- How to reserve your rights if there is a DIP lender.

- Understanding cash collateral order(s) and monthly operating reports.

- Determining if you have reclamation rights.

- What sale motions mean for creditors.

- Cure amounts and what to do if your agreement is assumed and assigned (or not assumed).

- Identifying critical vendors.

Friday, May 17

Swissotel Chicago, 323 East Upper Wacker Drive, Chicago, IL 60601

CYBERSECURITY FOR LAW FIRMS

ROOM: Alpine

![]()

![]()

SPEAKER: Marco Alcala, Alcala Consulting, Inc., Pasadena, CA

In the upcoming cybersecurity session tailored for legal professionals, attendees will gain invaluable insights into fortifying their digital practices against today’s most pervasive cyber threats. The program will kick off with an in-depth exploration of business email compromise (BEC), a type of cyber fraud that could devastate a firm’s financial integrity. We will unravel the deceptive tactics used by cybercriminals and provide practical defense strategies. The session will then pivot to the menacing landscape of ransomware attacks, discussing how these malicious software breaches can lock down critical data and disrupt legal operations. Participants will learn how to not only prevent such attacks but also how to respond effectively if they occur. Lastly, we will delve into the robust cybersecurity controls necessary for the protection of confidential client information. From encryption to two-factor authentication, lawyers will leave equipped with a toolkit of measures designed to uphold their ethical obligations in maintaining client confidentiality in the digital age.

LITIGATING ON DUAL FRONTS — EXAMINING WAR STORIES AND REAL-WORLD CASES INVOLVING LITIGATION INSIDE AND OUTSIDE BANKRUPTCY

ROOM: Alpine

![]()

![]()

![]()

PANELISTS: Joseph A. Marino, Marino, Mayers & Jarrach, LLC, Clifton, NJ; Randall Woolley, Darcy & Devassy PC, Chicago, IL; Kirk B. Burkley, Bernstein-Burkley, PC, Pittsburgh, PA

The panelists will address “cross-over” issues in the gray areas of the law that affect both bankruptcy and creditors’ rights attorneys. The program will be centered on real-world cases handled both inside and outside of bankruptcy. Discussions topics will include: fraudulent transfer cases (where a judgment against the principles is non-dischargeable), Ponzi scheme cases, (when there is a presumption of insolvency), RICO cases (when there is NO presumption of insolvency), director and officer litigation arising out of bankruptcy cases and judgment collection, dealing with bad faith filings and vexatious litigants, application of the Colorado River Doctrine and first to file rule, and debtor’s standing to prosecute claims outside of bankruptcy court.

SPEAKERS

Marco Alcala

Alcala Consulting, Inc., Pasadena, CA

Marco Alcala is the founder and CEO of Alcala Consulting. Marco graduated in 1997 with a Bachelor of Science in computer science from California State College, Northridge. He is the author of the cybersecurity book titled “Cyber Chump!” Marco also co-authored the Amazon #1 best-seller book “The Compliance Formula” with 20 other cybersecurity experts from around the world. When he’s not diving deeper into technology, Marco also loves dancing salsa and bachata – and when throwing a party, he’ll even pull out his conga drums and invite his guests to play along.

Robert Ash

Radius Global Solutions, Fair Lawn, NJ

Robert Ash is a seasoned veteran of the collection industry; with over 20 years’ experience in Accounts Receivable Management, Consumer Collections and Commercial Debt Collections. His longstanding career with AMS began in 1997, when Robert joined the collection team. After six years of delivering exceptional recovery results and service to AMS’ clients, Robert was promoted to Legal Department Manager. Robert’s financial expertise and strong communication skills provide a seamless transition from collections to litigation. As a member of the Commercial Law League of America (CLLA), Board of Governor’s Creditor’s Rights representative and active participation within the CLLA’s Eastern Regional Committee, Robert has developed and cultivated close associations with a network of collection attorneys throughout the country, ensuring AMS’ clients have the best representation to meet their legal needs.

Hon. Janet Baer

US Bankruptcy Court, Northern District of IL, Chicago, IL

Judge Janet S. Baer is a Bankruptcy Judge in the United Stated Bankruptcy Court for the Northern District of Illinois-Chicago. She has been on the bench in Chicago since March 2012. Prior to being appointed to the bench, Jan was a restructuring lawyer for over 25 years and involved in some of the most significant chapter 11 bankruptcy cases in the country. The majority of her practice focused on the representation of large publicly held debtors in both restructuring and chapter 11 matters. Jan was a partner at Kirkland & Ellis LLP, Winston & Strawn and Schwartz, Cooper, Greenberger & Krauss.

Judge Baer is a member of the ABI Board, the National and Chicago CARE Advisory Boards and the Chicago IWIRC Network Board. She is also a member of several committees for those organizations. She is the current President-elect of the National Conference of Bankruptcy Judges and a member of the 2024 class of Fellows of the American College of Bankruptcy. She is a frequent speaker for the ABI, TMA, Chicago Bar Association, IWIRC and NCBJ. Judge Baer also regularly acts as the Presiding Judge for the Northern District of Illinois in Naturalization ceremonies.

Matthew Brash

Newpoint Advisors Corporation, Schaumburg, IL

Matthew Brash is Senior Managing Director and lead professional of Newpoint’s TRAIL platform (Trustee, Receivership, Assignee, Interim Management (CXO), and Liquidation). A trusted leader, yielding cost-effective results, Matthew is a well-known and go-to resource in situations which require immediate action/deployment, strong management, communication, and performance. Matthew has collaborated with companies in all sectors and situations, national and global commercial lenders and third-party lenders, law firms, and key stakeholders in various turnaround stages. He enters any stage of a turnaround with the ultimate goal of “finding a path forward.”

Matthew is frequently called upon to serve as CXO, Court-Appointed Receiver to operating businesses and real estate (both in federal and state court), Assignee-Trustee in Assignments for the Benefit of Creditors, Liquidating Agent, and advisor to business owners, and serves as Subchapter V Trustee in the Northern District of Illinois, Eastern Division.

Matthew is the Illinois State Director for the Commercial Receivers Association, former Co-Chair of the Bankruptcy Court Liaison Committee for the Northern District of Illinois and served on various committees for the Turnaround Management Association. He has been quoted in numerous publications including the Wall Street Journal and Chicago Tribune.

George F. Braun

Law Offices of George Braun, Washington, DC

George F. Braun is an Agri-Business and PACA attorney/lobbyist who splits his time between San Diego, CA and Washington, DC. He has hands-on practice in the agri-business industry, addressing its’ needs in business and commercial litigation, PACA, Packers and Shippers Act and regular collections. He handles Agri-business transactions, insurance coverage issues, employment, labor, product liability, personal injury defense, land use litigation and transactions, including eminent domain and just compensation issues, environmental defense, litigation and arbitration, and litigation involving food safety.

Mr. Braun represents leading domestic and international companies in the agri-business, including growers, farming equipment manufacturers and suppliers, agricultural and environmental specialists, transportation companies, fertilizer and chemical producers and suppliers, and other companies involved in agriculture. Mr. Braun’s work includes compliance matters under the various state and federal agricultural programs, environmental compliance issues, land use and real estate matters affecting agriculture, and specialized litigation concerning agri-business. Mr. Braun is currently assisting numerous companies as they navigate the rigors of the Washington, DC Bureaucracy, the USDA, FDA, NIH, EPA and other Administration Agencies in the drafting of the new Rules and Regulations for Hemp and its’ related products.

Mr. Braun is also a member of the American Farm Bureau, Western Growers Association, the Produce Marketing Association, The International Fresh Produce Association, California Agricultural Production Consultants Association, The Pest Control Operators of California, The Heritage Foundation, The Republican National Lawyers Association and a Founding Member of The Federalist Society. He is the Washington Bureau Chief for KBLUam560 and the US Supreme Court Reporter or One America News Network.

Mr. Braun received a BS in Agricultural Economics from the University of Arizona and a JD from Golden Gate University School of Law/University of San Diego. He is admitted to practice and has tried cases in all of the State Courts and the United States District Courts in California, as well as, the United States Court of Appeals, Ninth Circuit. He has appeared before the US Supreme Court more than 40 times. He is a practicing member of the California and United States Supreme Court Bars.

Kirk B. Burkley

Bernstein-Burkley, PC, Pittsburgh, PA

Kirk B. Burkley is the Managing Partner of Bernstein-Burkley, P.C. Kirk’s practice emphasizes all aspects of bankruptcy and restructuring, creditors’ rights, business and corporate transactions, litigation, real estate and oil and gas. He’s a well-respected lawyer in his field, as evidenced by his numerous awards by many of the creditable lawyer lists that he has been presented. Kirk conducts seminars, live webinars and workshops on bankruptcy, creditors’ rights and oil and gas. He has lectured for the National Association of Credit Management (NACM), the American Bankruptcy Institute and the Pennsylvania Bar Institute, and is a regular panelist for NBI and Lorman Educational Services on various legal topics. Kirk has written several publications related to the bankruptcy field, with work appearing in ABI Journal, Equipment Leasing Newsletter, Pennsylvania Association of Credit Managers Newsletter the Creditor and more. He is an emeritus board member of the American Board of Certification as well as the past President and the past President of the Turnaround Management Association. He is a member of Allegheny County Bar Association, the American Bankruptcy Institute, and the Western District of Pennsylvania Local Rules Committee. Kirk earned his J.D. degree from the University of Pittsburgh School of Law and his B.S. degree from Ohio University.

Ben H. Farrow

Anderson, Williams & Farrow, LLC, Montgomery, AL

Ben Farrow was born in west Texas and raised in Colorado, Idaho and Louisiana attending Tulane University and the Louisiana State University for Law School. He worked as deckhand on the Mississippi River and in the Gulf of Mexico to pay for college and law school. After graduation and passing the Louisiana State Bar in 1992 he began his legal career as an Admiralty lawyer in New Orleans. He subsequently moved to Alabama and passed the Alabama Bar exam in 2000. He practiced as an insurance defense attorney for a few years and then found work at his current firm in 2002, becoming a partner in 2006. In 2015 he obtained his license to practice in Mississippi and the firm opened its Jackson office that same year.

Ben’s involvement with the Commercial Law League of America started with his current firm when he was introduced to the League by some colleagues. He was astonished at how well it fit his practice. He subsequently became interested in leadership in CLLA and was appointed the Education Chair. He has held that role for the last two years.

Thomas R. Fawkes

Tucker Ellis LLP, Chicago, IL

Thomas Fawkes is a partner in the Chicago office of Tucker Ellis LLP. Thomas focuses his practice on bankruptcy, restructuring and creditors’ rights matters, and represents unsecured and secured creditors, unsecured creditors’ committees, trustees, debtors, and asset purchasers in both complex bankruptcy cases and out-of-court workouts, and also has an active creditors’ rights practice, representing clients in commercial litigation matters and in structuring commercial transactions to mitigate bankruptcy and insolvency risk. Tom is an active speaker and writer on bankruptcy and creditors’ rights topics and his work has been recognized by Chambers & Partners and Turnarounds and Workouts, among others.

Hon. Judith Fitzgerald (Ret.)

Tucker Arensberg, PC, Pittsburgh, PA

Hon. Judith K. Fitzgerald (Ret.) A long-time member of CLLA, and Retired U.S. Bankruptcy has been blessed with an exciting, challenging and intellectually stimulating career. As a Judicial Law Clerk, Assistant U.S. Attorney, Chief Bankruptcy Judge, Professor of Law, Practitioner at Tucker Arensberg, Arbitrator, Mediator, Author and Expert Witness, she has experienced a wide variety of legal disciplines and administrative responsibilities. Judi is a Professor in the Practice of Law at the University of Pittsburgh School of Law, where she teaches Bankruptcy and Advanced Bankruptcy. She is active in national and local professional organizations including the Commercial Law League of America, the American Law Institute, the American College of Bankruptcy. The American Bankruptcy institute and the American Inns of Court. Among other offices, she has served as President of the National Conference of Bankruptcy Judges and as Chair of the Bankruptcy Judges Advisory Committee to the Administrative Office of the U.S. Courts. Judi has received numerous awards and recognitions including the Commercial Law League’s Lawrence P. King Award for Excellence in Bankruptcy and the American Inns of Court Bankruptcy Alliance Distinguished Service Award. Judi consults and lectures in matters involving trial strategy, evidence, procedure, contracts, bankruptcy and professional responsibility, and participates on several committees and boards dedicated to fostering legal education and improving access to justice.

Matias Eduardo Garcia

Barnett & Garcia, PLLC, Austin, TX

Matt Garcia is the managing member of Barnett & Garcia, PLLC, A graduate of the University of Texas at Austin School of Business and School of Law. Matt brings his sense of business to the practice of law.

For over 15 years, Matt and his firm have prosecuted hundreds of cases on behalf of insurance carriers, creditors and financial institutions in state and federal forums and have collected millions of dollars on their behalf.

Matt is admitted to the State Bar of Texas and the Western District of Texas and is a member of the Austin Bar Association, Commercial Law League of America, International Association of Commercial Collectors, and American Inns of Court, Robert Calvert Inn. He is a frequent speaker on various topics regarding credit, collections and judgment enforcement for the State Bar of Texas, Texas Justice Court Association, and various trade organizations.

Conor Kelly

Webster, Chamberlain & Bean, Washington, DC

Conor Kelly is an associate attorney at Webster, Chamberlain & Bean LLP in Washington, D.C. specializing in government relations. Before joining the firm, Conor worked as a counsel for Senator Amy Klobuchar on the U.S. Senate Committee on Rules and Administration, where he focused on issues including voting rights, election administration, and investigations into events surrounding January 6. He graduated from George Washington University Law School, where he served as a member of the Federal Communications Law Journal and worked in law clerk positions on Capitol Hill and with a voting rights nonprofit. He holds a B.A. from the University of Virginia, where he majored in history and government and wrote a thesis on the Iraq anti-war movement in the United States that won the history department’s award for best undergraduate thesis in modern American history.

Dan Kerrick

Hogan McDaniel, Wilmington, DE

Daniel C. Kerrick is an experienced litigator representing creditors of all size, type and geographic origin in Delaware state and federal courts. Dan represents a wide variety of clients in complex commercial disputes, judgment enforcement, corporate fiduciary litigation, business divorce and control disputes. Dan is a published author and speaks regularly about issues affecting creditors’ rights and remedies. Dan is a past chair of the CLLA Eastern Region and Young Members Section and served 2 terms on the CLLA Board of Governors. Dan is the current chair of the CLLA Government Affairs Committee.

Candice Kline

Saul Ewing, LLP, Chicago, IL

Candice Kline is a partner at Saul Ewing LLP focused on bankruptcy and restructuring situations. Her practice includes loan and deal work, including M&A, workouts, and loan administration. She represents debtors, creditors, fiduciaries, and public interest stakeholders. Candice serves in leadership at various bar and trade associations and on boards and advisory boards for nonprofit organizations, including the CLLA. She is also a part-time lecturer in law at the University of Toledo College of Law. Candice has an MBA (Chicago Booth) and began her legal career after many years in global commercial banking and business. She practices in Illinois and Ohio with a nationwide docket in complex commercial matters.

Hon. Thomas Lynch

US Bankruptcy Court, Northern District of IL, Rockford, IL

Hon. Thomas Lynch was appointed to the United States Bankruptcy Court for the Northern District of Illinois in January 2013. He is a graduate of the Northwestern University School of Law. Judge Lynch earned his undergraduate degree from the University of Dayton and M.A. from the University of Chicago.

Prior to joining the bench Judge Lynch practiced law in Chicago. He began his legal career in the litigation and bankruptcy departments of Winston & Strawn. He was a partner at Wildman, Harrold, Allen & Dixon and then at Baker & Daniels (now Faegre Drinker). For nearly thirty years he tried cases throughout the United States, representing clients in business disputes and bankruptcy and commercial matters. Before law school Tom was an economic analyst and executive in the public sector. While a senior executive in the City of Chicago’s Department of Finance during the late 1970’s, he assisted with the formulation and implementation of the city’s financial restructuring.

Judge Lynch has been an adjunct faculty member at the Northwestern University Pritzker School of Law since 1998. He also served on the faculty of the National Institute for Trial Advocacy (NITA) for more than two decades, and he frequently lectures on bankruptcy, financial issues, evidence and trial practice to the bench, bar, business organizations and the general public.

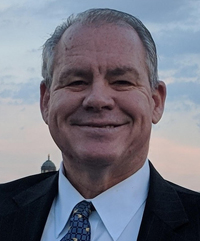

Joseph A. Marino

Marino, Mayers & Jarrach, LLC, Clifton, NJ

Joseph A Marino is a Creditors’ Rights Specialist, initially certified by the American Board of Certification 1994. Mr. Marino obtained his BS in Commerce from St. Louis University, MO in 1971 and obtained his Juris Doctor from the New England School of Law in 1976. He is admitted to practice law in the states of New Jersey and Florida as well as the District of Columbia. He is a member of the American Bar Association, the Association of Certified Fraud Examiners, and the Commercial Law League of America. He has served the CLLA as its Secretary and as the Chair of its Creditors’ Rights Section. He is a frequent lecturer on creditors rights topics, including those focused upon fraud and fraudulent transfers. He contributes articles periodically to the Commercial Law World magazine of the CLLA. He is also an affiliate member of the Commercial Collection Agencies of America and the Marino, Mayers & Jarrach firm is an associate member of the International Association of Commercial Collectors. Mr. Marino established his firm as a full-service Commercial Litigation Firm, assisting clients throughout the State of New Jersey and the United States of America, to provide comprehensive, skillful, and cost-effective services to our clients. The firm prosecutes all Creditor Rights Claims: from general collections to more Complex Commercial Litigation including Fraud and Fraudulent Transfers, Bankruptcy, Replevin and RICO. Mr. Marino is also a member of the Unico Foundation, Confrerie de la Chaine des Rotisseurs and International Honor Society of the Sovereign Military Order of St. John of Jerusalem, Knights of Malta. In 2018, Mr. Marino received the “Robert E. Caine Award for Leadership” from the Commercial Law League of America.

Ronald Peterson

Of Counsel at Jenner & Block, LLP, Chicago, IL

Ronald R. Peterson, Partner, Jenner & Block LLP in Chicago, Illinois. He concentrates his practice in the areas of commercial, insolvency and bankruptcy law. Mr. Peterson has presided over numerous complex commercial cases, including Stotler & Co., the country’s 10th largest commodities house, and Lancelot Investors Fund, L.P., a $1.7 billion Ponzi scheme. He is the Chairman of the Creditors’ Committee in Thomas J. Petters, a $3.5 billion Ponzi scheme. Mr. Peterson served as the examiner in the chapter 11 case of Robert Lund, a large real estate developer.

Mr. Peterson has been a member of the panel of Chapter 7 Trustees for the Northern District of Illinois, Eastern Division, since 1987. He is the past President of the National Association of Bankruptcy Trustees.

Mr. Peterson is a fellow of the American College of Bankruptcy and a member of the American Bankruptcy Institute. He is a member of the Business Bankruptcy Committee of the Business Law Section and the Bankruptcy Litigation Committee of the Litigation Section of the American Bar Association. He is a member of the International Association of Restructuring, Insolvency & Bankruptcy Professionals, and the Commercial Law League of America. In 2014, the Commercial Law League of America awarded Mr. Peterson the Lawrence P. King Award.

Bryan Press

Metro Group Maritime, Livingston, NJ

Bryan Press has been a practicing attorney for 40 years. He is licensed in Florida (1983) and New Jersey (1984). He is admitted to the Federal District Court and U.S. Bankruptcy Court of the District of New Jersey. He is also admitted to the 3rd and 11th Circuits. He has been engaged in creditor-debtor and insolvency practice for his entire career.

Mr. Press has been with Metro Group of NY since 2016, As Metro Group Maritime’s litigation liaison specialist and supervisor of receiving counsel, he undertakes the review of files in-house to ascertain the eligibility and viability of the claim in litigation and then coordinates with receiving counsel to effect prosecution and recovery.

Jack Rose

Law Offices of Jack Rose, PLLC, LLC, Bronxville, NY

Jack Rose 30+ years advising top-level executives on critical issues. Extensive legal knowledge combined with strong business acumen developed over a 30-year career focused on distressed and special situations at large international law firms acting as lead counsel in significant international matters. A skilled collaborator, problem solver, and negotiator who can effectively communicate complex issues in a clear and concise manner, driving towards desired goals. Exceptionally skilled in risk assessment, leading complex restructuring transactions, negotiating settlements, and managing processes efficiently within budget and timeline. A proven leader who achieves outstanding results. All matters at the firm are personally overseen by Mr. Rose subject to the firm’s standard staffing policies.

Zach B. Shelomith

LSS Law, Ft. Lauderdale, FL

Zach Shelomith is a founding member of LSS Law, in Fort Lauderdale, FL. He handles corporate and personal bankruptcy and insolvency law. Zach is Board Certified in Business Bankruptcy Law and Consumer Bankruptcy Law by the American Board of Certification.

Zach is the Chair of the Bankruptcy Law Section of the Commercial Law League of America and the Co-Chairperson of the Broward County Bar Association Bankruptcy Law Section. Zach is also a past president of the Bankruptcy Bar Association of the Southern District of Florida. Zach co-authored the book Individual Chapter 11, published by the American Bankruptcy Institute and has contributed to other articles of interest in the bankruptcy community.

Zach obtained a B.B.A. from the University of Miami and a J.D. from the University of Miami School of Law.

Gilbert M. Singer

Marcadis Singer P.A., Tampa, FL

Gilbert M. Singer is a creditors’ rights and collection attorney and is a Senior Partner in the law firm of Marcadis Singer, P. A. The firm provides legal counsel for clients across the State of Florida and has experienced attorneys who exclusively handle Florida cases in each of the 67 Florida counties.

He was born in New York, attended Emory University, graduated from the University of Miami School of Law in 1979 with a JD degree, and was admitted to The Florida Bar in 1979. He is also a member of the Hillsborough County Bar Association, the Commercial Law League of America in which he served as Southern Region Chair in 2018-2019, and the International Association of Commercial Collectors. Mr. Singer has had an AV Rating from Martindale-Hubbell for over 20 years.

In 2012, he was appointed by Governor Rick Scott to the 13th Judicial Circuit Nominating Commission. In 2018, he was elected as its Chair. Florida’s Judicial Nominating Commissions are constitutionally created non-partisan bodies designed to interview and nominate diverse, highly qualified candidates for judgeships to the Governor for appointment when a judicial vacancy arises. From 2002- 2020, he was a Commissioner with the Florida Commission on Human Relations and served a two-year term as its Chair, having been appointed by Governor Jeb Bush and reappointed by Governors Crist and Scott.

Mr. Singer has been a member of the Kiwanis Club of Tampa for over 44 years having previously served as its President in 1994-1995 and received its Kiwanian of the Year Award in 2002. He is also very active as a Board Member at A Kid’s Place which is a children’s shelter focused on keeping abused, abandoned, and neglected children together as sibling groups, For the Family, and currently serves as a Board Member and volunteer attorney for Crossroads Kids Florida which serves children aging out of the foster care system. He is a founding member and former President of The Grand Krewe of Libertalia, the first multi-cultural Krewe in Tampa history, and is a current member of the Royal Krewe of Privateers. He continues to serve on various non-profit boards.

In 1996 and again in 2023, Mr. Singer was the recipient of The Florida Bar President’s Pro Bono Award.

He currently is Chair of the Commercial Law League Southern Region and serves on the CRS and Legislative Committees for the CLLA.

Matthew Tabloff

Hilco Real Estate, LLC, Northbrook, IL

Matthew Tabloff, Executive Vice President & Partner, Hilco Real Estate, LLC, Northbrook, IL, has been with Hilco since 2006 and leads a team of industry experts in lease advisory, disposition, asset management and acquisitions. Matt has several high-level responsibilities, including directing operations of the lease advisory and disposition practices, business development, and developing and executing comprehensive strategies to maximize clients’ portfolio value (or minimize costs). A trusted advisor to financial institutions, bankers, advisory firms and executive teams, Matt has worked with clients across multiple industries and ranging from the strongest corporations to those in distress and/or bankruptcy. He has led Hilco’s Starbucks relationship for over a decade, assisting the company with asset management throughout North America, including Starbucks store leases and the wind down of Teavana as well as other top retailers such as Lowe’s, Dollar Tree Family Dollar, Tailored Brands, and Visionworks, among many others.

In addition, Matt led some of the largest retail restructurings of the last decade+, inclusive of grocers (A&P, Southeastern Grocers, Tops Markets, Marsh Supermarkets, etc), restaurant chains (California Pizza Kitchen, Fox & Hound/Champps, Ignite Restaurant Group, Bertucci’s, Applebee’s, Perkins, Houlihan’s, etc), traditional retailers (BCBG Max Azria, Christopher & Banks, True Religion, Centric Brands and many others), and fitness chains (24 Hour Fitness, Town Sports, YouFit, Crunch), and many other privately-held companies. Additionally, Matt and his team have led strategy and execution of non-retail repositioning as well, including lease restructurings on behalf of Art Institutes, Education Corporation of America (ECA), CRC Health, American Car Center, and many others.

Matt initially joined Hilco as a key member of the team that launched Hilco’s principal acquisition group, successfully acquiring fee and leasehold interests ranging from vacant buildings to raising capital for companies via sale-leaseback. He has a degree in Finance from University of Illinois at Urbana-Champaign, real estate broker’s license for the state of Illinois, and is an active member of ICSC and TMA.

William H. Thrush

Friedman, Framme & Thrush, P.A., Owings Mills, MD

William Thrush is a shareholder and the Managing Partner of Friedman, Framme & Thrush. Bill is an experienced trial attorney and has tried cases at all levels of court throughout the state of Maryland, as well as the District of Columbia and the Commonwealth of Virginia. Bill’s practice is currently focused on Banking and Commercial Finance, Commercial Loan Workout, Creditor’s Rights, and Corporate General Counsel Portfolio Management. In addition to his current practice focus, Bill has substantial experience in Contract Law, Personal Injury, Workers’ Compensation, Family Law, and General Litigation. In his spare time, Bill enjoys snowboarding, mountain biking, coaching youth lacrosse, scuba diving, and playing guitar.

Beverly Weiss Manne

Tucker Arensberg, PC, Pittsburgh, PA

Beverly Weiss Manne, Esq. is a shareholder, and was previously chairperson, of the Insolvency and Creditors’ Rights Department of the law firm of Tucker Arensberg, P.C. in Pittsburgh. Ms. Manne is admitted to practice in Pennsylvania and Maryland. Her practice includes complex bankruptcies and reorganizations, creditors’ rights, commercial loan originations, restructuring and liquidations, receiverships, and commercial lending/leasing workouts. Beverly also is an adjunct professor at the University of Pittsburgh School of Law where she teaches Commercial Paper and Banking (Payment Systems) and has taught Secured Transactions. Ms. Manne is a fellow of the American College of Bankruptcy, a member of the ABA, PBA and Allegheny County Bar Association, International Women’s Insolvency and Restructuring Confederation, Commercial Law League (“CLLA”), American Bankruptcy Institute, and a past Chair of the ACBA Bankruptcy and Commercial Law Section. She is the immediate past Chair of the PBA Business Law Section Council, co-chair of the Insolvency Law Modernization Task Force and the UCC Chapter 12 Adoption Task Force, and BLS’ representative in PBA’s House of Delegates. Ms. Manne is a member of the CLLA Education and Bankruptcy Executive Committee and has served on Western District Bankruptcy Court Chapter 11 Subchapter V Small Business procedures committees as well as the Complex Chapter 11 Procedures committee. Ms. Manne received her B.A. from the University of Pittsburgh, Magna Cum Laude, Phi Beta Kappa, and her law degree from University of Pittsburgh School of Law. She is a Pennsylvania Super Lawyer in Bankruptcy & Creditor/Debtor Rights Category for 2006 through the present, and; has been selected by her peers for inclusion in The Best Lawyers in America® 2007 through the present in the Bankruptcy and Creditor-Debtor Rights Law category.

Hon. Mary Ann Whipple

US Bankruptcy Court, Northern District of OH, Toledo, OH

Hon. Mary Ann Whipple has served as a United States Bankruptcy Judge for the Northern District of Ohio, Western Division, at Toledo, since 2001 and is currently the chief bankruptcy judge of the district. She also served on the Sixth Circuit Bankruptcy Appellate Panel.

Judge Whipple grew up in Toledo. She graduated from the University of Michigan in 1977 with an A.B. degree in Russian Studies and Stanford Law School in 1981 with a J.D. degree. Before becoming a bankruptcy judge, Judge Whipple practiced law for twenty years as a commercial, bankruptcy and employment litigator with the Toledo firm Fuller & Henry Ltd. She is admitted to practice in Ohio and Michigan.

Judge Whipple taught Creditor/Debtor Law for more than 20 years as a part-time faculty member at the University of Toledo College of Law. In addition to teaching, she has served her community as a member of the executive boards of the Owens Community College Foundation, American Red Cross-Greater Toledo Area Chapter, Lucas County Mental Health Board, Toledo Area Chamber of Commerce, Family Service of Northwest Ohio, and University of Michigan Club of Toledo. She is a master in and past President of The Morrison R. Waite Chapter of the American Inns of Court Foundation. Judge Whipple received The Toledo Bar Association’s 2008 Community Service Award and the Toledo Women’s Bar Association’s 2016 Arabella Babb Mansfield Award.

Randall Woolley

Darcy & Devassy PC, Chicago, IL

Randall Woolley concentrates his practice in creditor-side bankruptcy litigation and commercial litigation. Mr. Woolley represents his clients nationwide, in matters ranging from claims against lessees and borrowers for breach of contract, replevin and fraud, and representing creditors in bankruptcy proceedings, including filing claims, lift stay motions, objections to discharge, objections to plans, preparing cash collateral orders and defending preference and lien avoidance actions. Mr. Woolley received his bachelor’s degree from DePaul University in 1999 and his Juris Doctor from Loyola University Chicago School of Law in 2003. Mr. Woolley is a member of the Commercial Law League of America where he currently serves as a member of the Bankruptcy Section Executive Council and Chair of the Education Committee. Mr. Woolley is also a member of the Equipment Leasing and Finance Association and the Illinois State Bar Association. Mr. Woolley is licensed to practice law in Illinois, as well as the federal courts for Illinois and Indiana, the First Circuit Court of Appeals, and the Seventh Circuit Court of Appeals.

SPEAKERS

Marco Alcala

Alcala Consulting, Inc., Pasadena, CA

Marco Alcala is the founder and CEO of Alcala Consulting. Marco graduated in 1997 with a Bachelor of Science in computer science from California State College, Northridge. He is the author of the cybersecurity book titled “Cyber Chump!” Marco also co-authored the Amazon #1 best-seller book “The Compliance Formula” with 20 other cybersecurity experts from around the world. When he’s not diving deeper into technology, Marco also loves dancing salsa and bachata – and when throwing a party, he’ll even pull out his conga drums and invite his guests to play along.

Robert Ash

Radius Global Solutions, Fair Lawn, NJ

Robert Ash is a seasoned veteran of the collection industry; with over 20 years’ experience in Accounts Receivable Management, Consumer Collections and Commercial Debt Collections. His longstanding career with AMS began in 1997, when Robert joined the collection team. After six years of delivering exceptional recovery results and service to AMS’ clients, Robert was promoted to Legal Department Manager. Robert’s financial expertise and strong communication skills provide a seamless transition from collections to litigation. As a member of the Commercial Law League of America (CLLA), Board of Governor’s Creditor’s Rights representative and active participation within the CLLA’s Eastern Regional Committee, Robert has developed and cultivated close associations with a network of collection attorneys throughout the country, ensuring AMS’ clients have the best representation to meet their legal needs.

Hon. Janet Baer

US Bankruptcy Court, Northern District of IL, Chicago, IL

Judge Janet S. Baer is a Bankruptcy Judge in the United Stated Bankruptcy Court for the Northern District of Illinois-Chicago. She has been on the bench in Chicago since March 2012. Prior to being appointed to the bench, Jan was a restructuring lawyer for over 25 years and involved in some of the most significant chapter 11 bankruptcy cases in the country. The majority of her practice focused on the representation of large publicly held debtors in both restructuring and chapter 11 matters. Jan was a partner at Kirkland & Ellis LLP, Winston & Strawn and Schwartz, Cooper, Greenberger & Krauss.

Judge Baer is a member of the ABI Board, the National and Chicago CARE Advisory Boards and the Chicago IWIRC Network Board. She is also a member of several committees for those organizations. She is the current President-elect of the National Conference of Bankruptcy Judges and a member of the 2024 class of Fellows of the American College of Bankruptcy. She is a frequent speaker for the ABI, TMA, Chicago Bar Association, IWIRC and NCBJ. Judge Baer also regularly acts as the Presiding Judge for the Northern District of Illinois in Naturalization ceremonies.

Matthew Brash

Newpoint Advisors Corporation, Schaumburg, IL

Matthew Brash is Senior Managing Director and lead professional of Newpoint’s TRAIL platform (Trustee, Receivership, Assignee, Interim Management (CXO), and Liquidation). A trusted leader, yielding cost-effective results, Matthew is a well-known and go-to resource in situations which require immediate action/deployment, strong management, communication, and performance. Matthew has collaborated with companies in all sectors and situations, national and global commercial lenders and third-party lenders, law firms, and key stakeholders in various turnaround stages. He enters any stage of a turnaround with the ultimate goal of “finding a path forward.”

Matthew is frequently called upon to serve as CXO, Court-Appointed Receiver to operating businesses and real estate (both in federal and state court), Assignee-Trustee in Assignments for the Benefit of Creditors, Liquidating Agent, and advisor to business owners, and serves as Subchapter V Trustee in the Northern District of Illinois, Eastern Division.

Matthew is the Illinois State Director for the Commercial Receivers Association, former Co-Chair of the Bankruptcy Court Liaison Committee for the Northern District of Illinois and served on various committees for the Turnaround Management Association. He has been quoted in numerous publications including the Wall Street Journal and Chicago Tribune.

George F. Braun

Law Offices of George Braun, Washington, DC

George F. Braun is an Agri-Business and PACA attorney/lobbyist who splits his time between San Diego, CA and Washington, DC. He has hands-on practice in the agri-business industry, addressing its’ needs in business and commercial litigation, PACA, Packers and Shippers Act and regular collections. He handles Agri-business transactions, insurance coverage issues, employment, labor, product liability, personal injury defense, land use litigation and transactions, including eminent domain and just compensation issues, environmental defense, litigation and arbitration, and litigation involving food safety.

Mr. Braun represents leading domestic and international companies in the agri-business, including growers, farming equipment manufacturers and suppliers, agricultural and environmental specialists, transportation companies, fertilizer and chemical producers and suppliers, and other companies involved in agriculture. Mr. Braun’s work includes compliance matters under the various state and federal agricultural programs, environmental compliance issues, land use and real estate matters affecting agriculture, and specialized litigation concerning agri-business. Mr. Braun is currently assisting numerous companies as they navigate the rigors of the Washington, DC Bureaucracy, the USDA, FDA, NIH, EPA and other Administration Agencies in the drafting of the new Rules and Regulations for Hemp and its’ related products.

Mr. Braun is also a member of the American Farm Bureau, Western Growers Association, the Produce Marketing Association, The International Fresh Produce Association, California Agricultural Production Consultants Association, The Pest Control Operators of California, The Heritage Foundation, The Republican National Lawyers Association and a Founding Member of The Federalist Society. He is the Washington Bureau Chief for KBLUam560 and the US Supreme Court Reporter or One America News Network.

Mr. Braun received a BS in Agricultural Economics from the University of Arizona and a JD from Golden Gate University School of Law/University of San Diego. He is admitted to practice and has tried cases in all of the State Courts and the United States District Courts in California, as well as, the United States Court of Appeals, Ninth Circuit. He has appeared before the US Supreme Court more than 40 times. He is a practicing member of the California and United States Supreme Court Bars.

Kirk B. Burkley

Bernstein-Burkley, PC, Pittsburgh, PA

Kirk B. Burkley is the Managing Partner of Bernstein-Burkley, P.C. Kirk’s practice emphasizes all aspects of bankruptcy and restructuring, creditors’ rights, business and corporate transactions, litigation, real estate and oil and gas. He’s a well-respected lawyer in his field, as evidenced by his numerous awards by many of the creditable lawyer lists that he has been presented. Kirk conducts seminars, live webinars and workshops on bankruptcy, creditors’ rights and oil and gas. He has lectured for the National Association of Credit Management (NACM), the American Bankruptcy Institute and the Pennsylvania Bar Institute, and is a regular panelist for NBI and Lorman Educational Services on various legal topics. Kirk has written several publications related to the bankruptcy field, with work appearing in ABI Journal, Equipment Leasing Newsletter, Pennsylvania Association of Credit Managers Newsletter the Creditor and more. He is an emeritus board member of the American Board of Certification as well as the past President and the past President of the Turnaround Management Association. He is a member of Allegheny County Bar Association, the American Bankruptcy Institute, and the Western District of Pennsylvania Local Rules Committee. Kirk earned his J.D. degree from the University of Pittsburgh School of Law and his B.S. degree from Ohio University.

Ben H. Farrow

Anderson, Williams & Farrow, LLC, Montgomery, AL

Ben Farrow was born in west Texas and raised in Colorado, Idaho and Louisiana attending Tulane University and the Louisiana State University for Law School. He worked as deckhand on the Mississippi River and in the Gulf of Mexico to pay for college and law school. After graduation and passing the Louisiana State Bar in 1992 he began his legal career as an Admiralty lawyer in New Orleans. He subsequently moved to Alabama and passed the Alabama Bar exam in 2000. He practiced as an insurance defense attorney for a few years and then found work at his current firm in 2002, becoming a partner in 2006. In 2015 he obtained his license to practice in Mississippi and the firm opened its Jackson office that same year.

Ben’s involvement with the Commercial Law League of America started with his current firm when he was introduced to the League by some colleagues. He was astonished at how well it fit his practice. He subsequently became interested in leadership in CLLA and was appointed the Education Chair. He has held that role for the last two years.

Thomas R. Fawkes

Tucker Ellis LLP, Chicago, IL

Thomas Fawkes is a partner in the Chicago office of Tucker Ellis LLP. Thomas focuses his practice on bankruptcy, restructuring and creditors’ rights matters, and represents unsecured and secured creditors, unsecured creditors’ committees, trustees, debtors, and asset purchasers in both complex bankruptcy cases and out-of-court workouts, and also has an active creditors’ rights practice, representing clients in commercial litigation matters and in structuring commercial transactions to mitigate bankruptcy and insolvency risk. Tom is an active speaker and writer on bankruptcy and creditors’ rights topics and his work has been recognized by Chambers & Partners and Turnarounds and Workouts, among others.

Hon. Judith Fitzgerald (Ret.)

Tucker Arensberg, PC, Pittsburgh, PA

Hon. Judith K. Fitzgerald (Ret.) A long-time member of CLLA, and Retired U.S. Bankruptcy has been blessed with an exciting, challenging and intellectually stimulating career. As a Judicial Law Clerk, Assistant U.S. Attorney, Chief Bankruptcy Judge, Professor of Law, Practitioner at Tucker Arensberg, Arbitrator, Mediator, Author and Expert Witness, she has experienced a wide variety of legal disciplines and administrative responsibilities. Judi is a Professor in the Practice of Law at the University of Pittsburgh School of Law, where she teaches Bankruptcy and Advanced Bankruptcy. She is active in national and local professional organizations including the Commercial Law League of America, the American Law Institute, the American College of Bankruptcy. The American Bankruptcy institute and the American Inns of Court. Among other offices, she has served as President of the National Conference of Bankruptcy Judges and as Chair of the Bankruptcy Judges Advisory Committee to the Administrative Office of the U.S. Courts. Judi has received numerous awards and recognitions including the Commercial Law League’s Lawrence P. King Award for Excellence in Bankruptcy and the American Inns of Court Bankruptcy Alliance Distinguished Service Award. Judi consults and lectures in matters involving trial strategy, evidence, procedure, contracts, bankruptcy and professional responsibility, and participates on several committees and boards dedicated to fostering legal education and improving access to justice.

Matias Eduardo Garcia

Barnett & Garcia, PLLC, Austin, TX

Matt Garcia is the managing member of Barnett & Garcia, PLLC, A graduate of the University of Texas at Austin School of Business and School of Law. Matt brings his sense of business to the practice of law.

For over 15 years, Matt and his firm have prosecuted hundreds of cases on behalf of insurance carriers, creditors and financial institutions in state and federal forums and have collected millions of dollars on their behalf.

Matt is admitted to the State Bar of Texas and the Western District of Texas and is a member of the Austin Bar Association, Commercial Law League of America, International Association of Commercial Collectors, and American Inns of Court, Robert Calvert Inn. He is a frequent speaker on various topics regarding credit, collections and judgment enforcement for the State Bar of Texas, Texas Justice Court Association, and various trade organizations.

Conor Kelly

Webster, Chamberlain & Bean, Washington, DC

Conor Kelly is an associate attorney at Webster, Chamberlain & Bean LLP in Washington, D.C. specializing in government relations. Before joining the firm, Conor worked as a counsel for Senator Amy Klobuchar on the U.S. Senate Committee on Rules and Administration, where he focused on issues including voting rights, election administration, and investigations into events surrounding January 6. He graduated from George Washington University Law School, where he served as a member of the Federal Communications Law Journal and worked in law clerk positions on Capitol Hill and with a voting rights nonprofit. He holds a B.A. from the University of Virginia, where he majored in history and government and wrote a thesis on the Iraq anti-war movement in the United States that won the history department’s award for best undergraduate thesis in modern American history.

Dan Kerrick

Hogan McDaniel, Wilmington, DE

Daniel C. Kerrick is an experienced litigator representing creditors of all size, type and geographic origin in Delaware state and federal courts. Dan represents a wide variety of clients in complex commercial disputes, judgment enforcement, corporate fiduciary litigation, business divorce and control disputes. Dan is a published author and speaks regularly about issues affecting creditors’ rights and remedies. Dan is a past chair of the CLLA Eastern Region and Young Members Section and served 2 terms on the CLLA Board of Governors. Dan is the current chair of the CLLA Government Affairs Committee.

Candice Kline

Saul Ewing, LLP, Chicago, IL

Candice Kline is a partner at Saul Ewing LLP focused on bankruptcy and restructuring situations. Her practice includes loan and deal work, including M&A, workouts, and loan administration. She represents debtors, creditors, fiduciaries, and public interest stakeholders. Candice serves in leadership at various bar and trade associations and on boards and advisory boards for nonprofit organizations, including the CLLA. She is also a part-time lecturer in law at the University of Toledo College of Law. Candice has an MBA (Chicago Booth) and began her legal career after many years in global commercial banking and business. She practices in Illinois and Ohio with a nationwide docket in complex commercial matters.

Hon. Thomas Lynch

US Bankruptcy Court, Northern District of IL, Rockford, IL

Hon. Thomas Lynch was appointed to the United States Bankruptcy Court for the Northern District of Illinois in January 2013. He is a graduate of the Northwestern University School of Law. Judge Lynch earned his undergraduate degree from the University of Dayton and M.A. from the University of Chicago.

Prior to joining the bench Judge Lynch practiced law in Chicago. He began his legal career in the litigation and bankruptcy departments of Winston & Strawn. He was a partner at Wildman, Harrold, Allen & Dixon and then at Baker & Daniels (now Faegre Drinker). For nearly thirty years he tried cases throughout the United States, representing clients in business disputes and bankruptcy and commercial matters. Before law school Tom was an economic analyst and executive in the public sector. While a senior executive in the City of Chicago’s Department of Finance during the late 1970’s, he assisted with the formulation and implementation of the city’s financial restructuring.

Judge Lynch has been an adjunct faculty member at the Northwestern University Pritzker School of Law since 1998. He also served on the faculty of the National Institute for Trial Advocacy (NITA) for more than two decades, and he frequently lectures on bankruptcy, financial issues, evidence and trial practice to the bench, bar, business organizations and the general public.

Joseph A. Marino

Marino, Mayers & Jarrach, LLC, Clifton, NJ

Joseph A Marino is a Creditors’ Rights Specialist, initially certified by the American Board of Certification 1994. Mr. Marino obtained his BS in Commerce from St. Louis University, MO in 1971 and obtained his Juris Doctor from the New England School of Law in 1976. He is admitted to practice law in the states of New Jersey and Florida as well as the District of Columbia. He is a member of the American Bar Association, the Association of Certified Fraud Examiners, and the Commercial Law League of America. He has served the CLLA as its Secretary and as the Chair of its Creditors’ Rights Section. He is a frequent lecturer on creditors rights topics, including those focused upon fraud and fraudulent transfers. He contributes articles periodically to the Commercial Law World magazine of the CLLA. He is also an affiliate member of the Commercial Collection Agencies of America and the Marino, Mayers & Jarrach firm is an associate member of the International Association of Commercial Collectors. Mr. Marino established his firm as a full-service Commercial Litigation Firm, assisting clients throughout the State of New Jersey and the United States of America, to provide comprehensive, skillful, and cost-effective services to our clients. The firm prosecutes all Creditor Rights Claims: from general collections to more Complex Commercial Litigation including Fraud and Fraudulent Transfers, Bankruptcy, Replevin and RICO. Mr. Marino is also a member of the Unico Foundation, Confrerie de la Chaine des Rotisseurs and International Honor Society of the Sovereign Military Order of St. John of Jerusalem, Knights of Malta. In 2018, Mr. Marino received the “Robert E. Caine Award for Leadership” from the Commercial Law League of America.

Ronald Peterson

Of Counsel at Jenner & Block, LLP, Chicago, IL

Ronald R. Peterson, Partner, Jenner & Block LLP in Chicago, Illinois. He concentrates his practice in the areas of commercial, insolvency and bankruptcy law. Mr. Peterson has presided over numerous complex commercial cases, including Stotler & Co., the country’s 10th largest commodities house, and Lancelot Investors Fund, L.P., a $1.7 billion Ponzi scheme. He is the Chairman of the Creditors’ Committee in Thomas J. Petters, a $3.5 billion Ponzi scheme. Mr. Peterson served as the examiner in the chapter 11 case of Robert Lund, a large real estate developer.

Mr. Peterson has been a member of the panel of Chapter 7 Trustees for the Northern District of Illinois, Eastern Division, since 1987. He is the past President of the National Association of Bankruptcy Trustees.

Mr. Peterson is a fellow of the American College of Bankruptcy and a member of the American Bankruptcy Institute. He is a member of the Business Bankruptcy Committee of the Business Law Section and the Bankruptcy Litigation Committee of the Litigation Section of the American Bar Association. He is a member of the International Association of Restructuring, Insolvency & Bankruptcy Professionals, and the Commercial Law League of America. In 2014, the Commercial Law League of America awarded Mr. Peterson the Lawrence P. King Award.

Bryan Press

Metro Group Maritime, Livingston, NJ

Bryan Press has been a practicing attorney for 40 years. He is licensed in Florida (1983) and New Jersey (1984). He is admitted to the Federal District Court and U.S. Bankruptcy Court of the District of New Jersey. He is also admitted to the 3rd and 11th Circuits. He has been engaged in creditor-debtor and insolvency practice for his entire career.

Mr. Press has been with Metro Group of NY since 2016, As Metro Group Maritime’s litigation liaison specialist and supervisor of receiving counsel, he undertakes the review of files in-house to ascertain the eligibility and viability of the claim in litigation and then coordinates with receiving counsel to effect prosecution and recovery.

Jack Rose

Law Offices of Jack Rose, PLLC, LLC, Bronxville, NY

Jack Rose 30+ years advising top-level executives on critical issues. Extensive legal knowledge combined with strong business acumen developed over a 30-year career focused on distressed and special situations at large international law firms acting as lead counsel in significant international matters. A skilled collaborator, problem solver, and negotiator who can effectively communicate complex issues in a clear and concise manner, driving towards desired goals. Exceptionally skilled in risk assessment, leading complex restructuring transactions, negotiating settlements, and managing processes efficiently within budget and timeline. A proven leader who achieves outstanding results. All matters at the firm are personally overseen by Mr. Rose subject to the firm’s standard staffing policies.

Zach B. Shelomith

LSS Law, Ft. Lauderdale, FL

Zach Shelomith is a founding member of LSS Law, in Fort Lauderdale, FL. He handles corporate and personal bankruptcy and insolvency law. Zach is Board Certified in Business Bankruptcy Law and Consumer Bankruptcy Law by the American Board of Certification.

Zach is the Chair of the Bankruptcy Law Section of the Commercial Law League of America and the Co-Chairperson of the Broward County Bar Association Bankruptcy Law Section. Zach is also a past president of the Bankruptcy Bar Association of the Southern District of Florida. Zach co-authored the book Individual Chapter 11, published by the American Bankruptcy Institute and has contributed to other articles of interest in the bankruptcy community.

Zach obtained a B.B.A. from the University of Miami and a J.D. from the University of Miami School of Law.

Gilbert M. Singer

Marcadis Singer P.A., Tampa, FL

Gilbert M. Singer is a creditors’ rights and collection attorney and is a Senior Partner in the law firm of Marcadis Singer, P. A. The firm provides legal counsel for clients across the State of Florida and has experienced attorneys who exclusively handle Florida cases in each of the 67 Florida counties.

He was born in New York, attended Emory University, graduated from the University of Miami School of Law in 1979 with a JD degree, and was admitted to The Florida Bar in 1979. He is also a member of the Hillsborough County Bar Association, the Commercial Law League of America in which he served as Southern Region Chair in 2018-2019, and the International Association of Commercial Collectors. Mr. Singer has had an AV Rating from Martindale-Hubbell for over 20 years.

In 2012, he was appointed by Governor Rick Scott to the 13th Judicial Circuit Nominating Commission. In 2018, he was elected as its Chair. Florida’s Judicial Nominating Commissions are constitutionally created non-partisan bodies designed to interview and nominate diverse, highly qualified candidates for judgeships to the Governor for appointment when a judicial vacancy arises. From 2002- 2020, he was a Commissioner with the Florida Commission on Human Relations and served a two-year term as its Chair, having been appointed by Governor Jeb Bush and reappointed by Governors Crist and Scott.

Mr. Singer has been a member of the Kiwanis Club of Tampa for over 44 years having previously served as its President in 1994-1995 and received its Kiwanian of the Year Award in 2002. He is also very active as a Board Member at A Kid’s Place which is a children’s shelter focused on keeping abused, abandoned, and neglected children together as sibling groups, For the Family, and currently serves as a Board Member and volunteer attorney for Crossroads Kids Florida which serves children aging out of the foster care system. He is a founding member and former President of The Grand Krewe of Libertalia, the first multi-cultural Krewe in Tampa history, and is a current member of the Royal Krewe of Privateers. He continues to serve on various non-profit boards.

In 1996 and again in 2023, Mr. Singer was the recipient of The Florida Bar President’s Pro Bono Award.

He currently is Chair of the Commercial Law League Southern Region and serves on the CRS and Legislative Committees for the CLLA.

Matthew Tabloff

Hilco Real Estate, LLC, Northbrook, IL

Matthew Tabloff, Executive Vice President & Partner, Hilco Real Estate, LLC, Northbrook, IL, has been with Hilco since 2006 and leads a team of industry experts in lease advisory, disposition, asset management and acquisitions. Matt has several high-level responsibilities, including directing operations of the lease advisory and disposition practices, business development, and developing and executing comprehensive strategies to maximize clients’ portfolio value (or minimize costs). A trusted advisor to financial institutions, bankers, advisory firms and executive teams, Matt has worked with clients across multiple industries and ranging from the strongest corporations to those in distress and/or bankruptcy. He has led Hilco’s Starbucks relationship for over a decade, assisting the company with asset management throughout North America, including Starbucks store leases and the wind down of Teavana as well as other top retailers such as Lowe’s, Dollar Tree Family Dollar, Tailored Brands, and Visionworks, among many others.

In addition, Matt led some of the largest retail restructurings of the last decade+, inclusive of grocers (A&P, Southeastern Grocers, Tops Markets, Marsh Supermarkets, etc), restaurant chains (California Pizza Kitchen, Fox & Hound/Champps, Ignite Restaurant Group, Bertucci’s, Applebee’s, Perkins, Houlihan’s, etc), traditional retailers (BCBG Max Azria, Christopher & Banks, True Religion, Centric Brands and many others), and fitness chains (24 Hour Fitness, Town Sports, YouFit, Crunch), and many other privately-held companies. Additionally, Matt and his team have led strategy and execution of non-retail repositioning as well, including lease restructurings on behalf of Art Institutes, Education Corporation of America (ECA), CRC Health, American Car Center, and many others.

Matt initially joined Hilco as a key member of the team that launched Hilco’s principal acquisition group, successfully acquiring fee and leasehold interests ranging from vacant buildings to raising capital for companies via sale-leaseback. He has a degree in Finance from University of Illinois at Urbana-Champaign, real estate broker’s license for the state of Illinois, and is an active member of ICSC and TMA.

William H. Thrush

Friedman, Framme & Thrush, P.A., Owings Mills, MD

William Thrush is a shareholder and the Managing Partner of Friedman, Framme & Thrush. Bill is an experienced trial attorney and has tried cases at all levels of court throughout the state of Maryland, as well as the District of Columbia and the Commonwealth of Virginia. Bill’s practice is currently focused on Banking and Commercial Finance, Commercial Loan Workout, Creditor’s Rights, and Corporate General Counsel Portfolio Management. In addition to his current practice focus, Bill has substantial experience in Contract Law, Personal Injury, Workers’ Compensation, Family Law, and General Litigation. In his spare time, Bill enjoys snowboarding, mountain biking, coaching youth lacrosse, scuba diving, and playing guitar.

Beverly Weiss Manne

Tucker Arensberg, PC, Pittsburgh, PA